how to calculate tax

If you are declaring a higherlower CVRA weight visit Registration Fees to calculate an estimate of the correct CVRA weight fee. Tax deductions on the other hand reduce how.

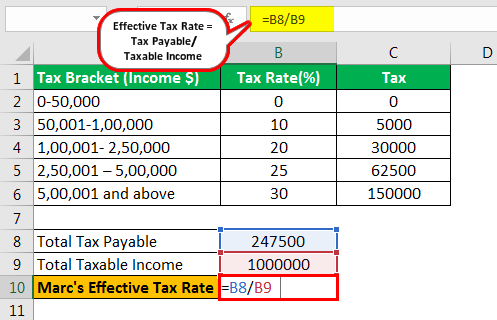

Marginal Tax Rate Definition Formula How To Calculate

Internal Revenue Service 1-800-829-1040 or wwwIRSgov.

. Tax deductions and tax credits are the biggest breaks youll get from the IRS. How to Use the Online Income Tax Calculator. Calculate the customs charges youll need to pay when bringing goods into the UK and learn how Wise can help you manage your business across borders.

This also applies to some motorhomes. Pro Investing by Aditya Birla Sun Life Mutual Fund. For example lets assume you had a bonus of 5000.

The tax calculator allows taxpayers and agents to work out the amount of LBTT payable on residential non-residential or mixed property transactions and non-residential lease transactions based on the rates and thresholds. Then you can estimate your taxable income by subtracting allowable deductions from your AGI. As already mentioned Income tax in India differs based on different age groups.

You will also be able to see a comparison of your pre-budget and post-budget tax liability old tax slabs and new tax slabs. Under this method your employer applies a flat tax rate of 22 to the bonus amount. Using a Static Method.

Java code to calculate income tax for company or for employee The following income tax calculator on java has been written in 4 different ways. W-2 income. Remember to convert the sales tax percentage to decimal format.

The above calculator provides for interest calculation as per Income-tax Act. Choose the assessment year for which you want to calculate the tax. Determine if sales taxes are charged on the sale.

Tax credits directly reduce the amount of tax you owe dollar for dollar. How to calculate the cannabis duty and additional cannabis duty on your sales Driedfresh cannabis cannabis plants and cannabis plant seeds. You might need to use the market value instead of.

Income Tax Calculator. Here is how you compute your income from a house property. Meaning your pay before taxes and other payroll deductions are taken out.

Next click on the income field. To find PCB for the current month calculate. P M R B Z X -n 1.

In the next field select your age. That amount is then withheld from your bonus for federal taxes. Multiply the net price of your vehicle by the sales tax percentage.

However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. If you owned the asset before 2003 you may claim indexation relief. Some tangible items such as groceries seeds fertilizer and prescription medicines are exempt from Florida sales tax.

Franchise Tax Board 1-800-338-0505 or wwwftbcagov. In case you want to calculate your taxes under the old tax slabsyou will have to enter your tax saving investments under section 80C 80D 80G 80E and 80TTA. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004.

Florida residents do not need to pay sales taxes on intangible purchases like investments. Click on Calculate to get your tax liability. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour.

The tables only go up to 99999 so if your income is 100000 or higher you must use a separate worksheet found in the Form 1040 Instructions to calculate your tax. You also need to deduct any losses. Suitable examples and sample programs have been included in order to make you understand simply.

How to calculate Income Tax using Income Tax Calculator by The Economic Times. If you have more than one gain add them together. Tax will be due on the cost of the goods and shipping which in this case is 22000 15000 7000.

The biggest tax deduction for sole proprietors partnerships LLCs and S corporations is a 20 deduction on all income. Calculate your tax using the percentage method option 1. How to calculate Income From House Property.

Calculate your chargeable gain for the whole tax year. The sales tax is calculated by multiplying the sale price by the current combined state and local sales tax rate. Deductions reduce your taxable income while tax credits reduce the actual amount you owe to the IRS.

Sales tax is only charged on purchases of tangible products or some services. How to calculate FICA payroll tax Social Security withholding. Follow the below-given steps to use the tax calculator.

Unlike your 1099 income be sure to input your gross wages. So make sure to file your 2019 Tax Return as soon as possible. Where P Total chargeable income for the year M First chargeable income for every range of chargeable income a year R Percentage of tax rates B Amount of tax on M after deduction of tax rebate for.

Next figure the taxable portion by subtracting the tax-free portion from your total distribution. As a cannabis licensee who packages and stamps dried or fresh cannabis cannabis plants and cannabis plant seeds the cannabis duty and additional cannabis duty if applicable you must pay is the higher of. If you need to calculate your federal income tax start by estimate your adjusted gross income or AGI.

The gross annual value of a self-occupied house is zeroFor a let. Calculate the taxable portion of your early IRA withdrawal. NSE Gainer-Large Cap.

Determine Gross Annual Value GAV of the property. This box is optional but if you had W-2 earnings you can put them in here. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your personal tax questions.

After July 15 2023 you will no longer be able to claim your 2019 Tax Refund through your Tax Return. While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. To calculate Social Security withholding multiply your employees gross pay for the current pay period by the current Social Security tax rate 62.

For traditional IRAs first figure the tax-free portion by multiplying your distribution by the amount of nondeductible contributions in the IRA divided by the IRA value. First tax payment when you register the vehicle Youll pay a rate based on a vehicles CO2 emissions the first time its registered. Say a restaurant outing produced a before-tax price of 205 in the Chicago area outside of the McPier Tax Zone so that the sales tax rate is 1025 percent.

After you calculate your tax on taxable income subtract credits and make other adjustments to arrive at the final net federal income tax amount. Your employer would withhold a straight 1100 22 from this amount. The methods used in this article are as follows.

How to pay import tax. To illustrate lets say your taxable income Line 15 on Form 1040 is 41049. For simplicitys sake the tax tables list all income over 3000 in 50 chunks.

This is the amount you will deduct from your employees paycheck and remit along with your payroll taxes. A tax credit valued at 1000 for instance lowers your tax bill by 1000. Step by Step guide on how to calculate Income Tax tax slabs online.

How To Calculate California Sales Tax 11 Steps With Pictures

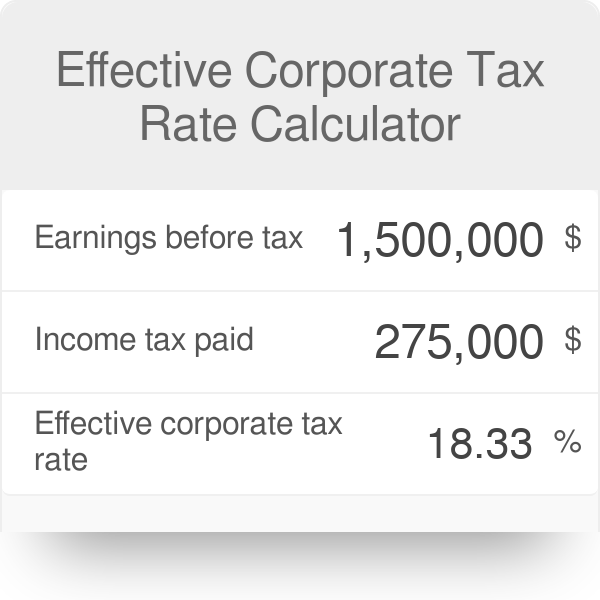

Effective Corporate Tax Rate Calculator

How To Calculate Payroll Taxes In 5 Steps

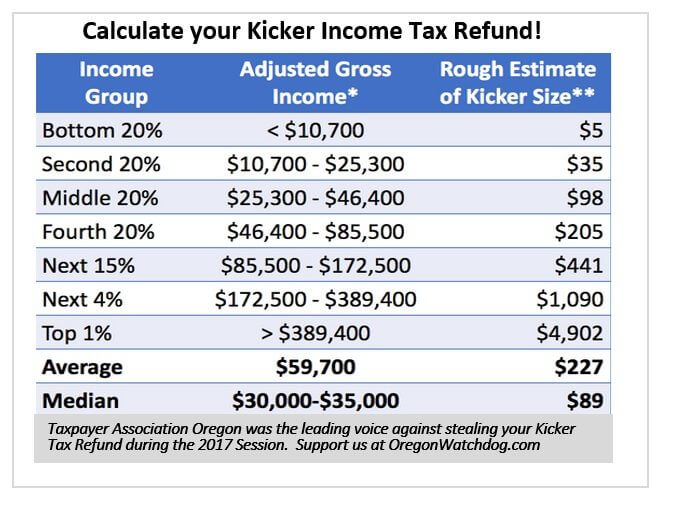

Calculate Your Kicker Income Tax Refund The Oregon Catalyst

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

How To Calculate Tax Title And License In Texas Calculating Taxes On Newly Bought Cars

How To Calculate Payroll Taxes For Your Small Business

How To Calculate Fl Sales Tax On Rent

How To Calculate Income Tax In Excel

How To Calculate Taxable Income H R Block

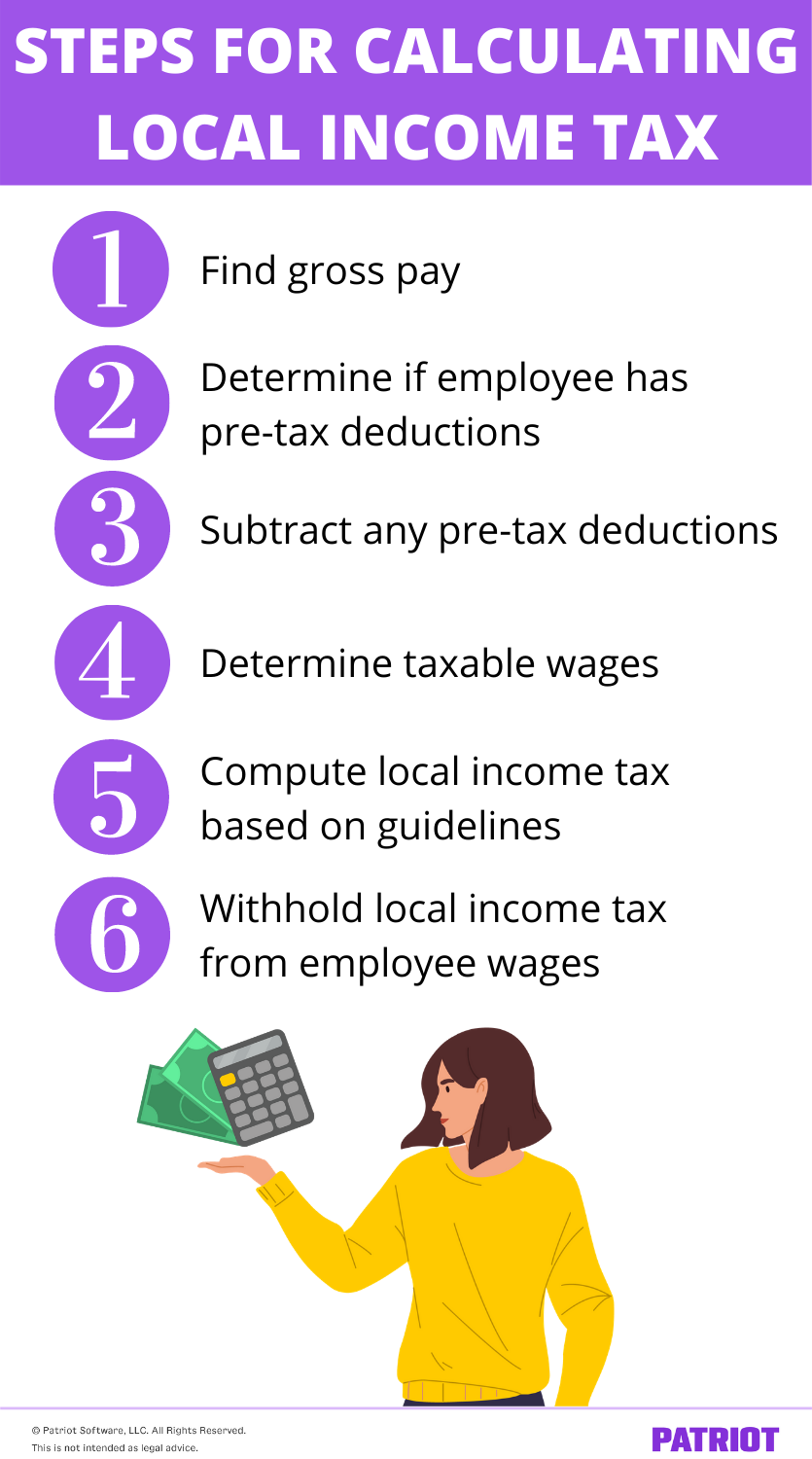

How To Calculate Local Income Tax Steps More

Tax Calculator Estimate Your Income Tax For 2022 Free

4 Ways To Calculate Sales Tax Wikihow

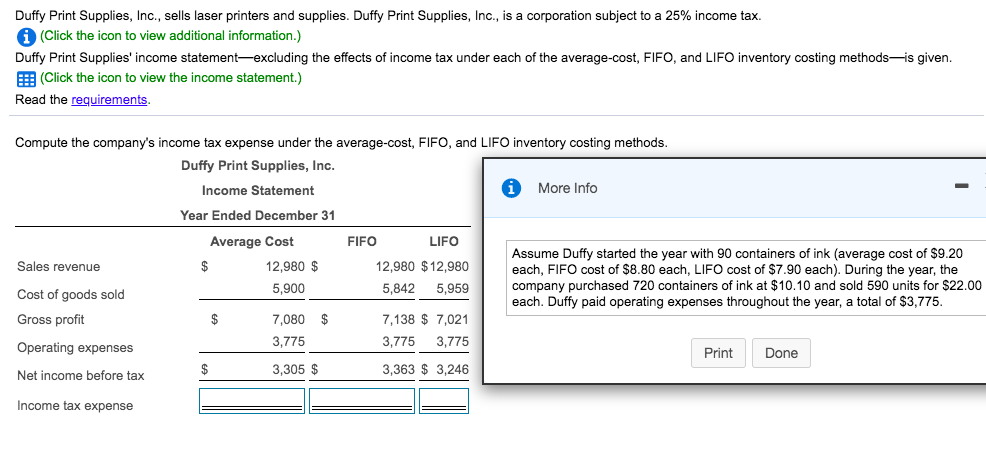

Solved How Do I Calculate Income Tax Expense For Average Chegg Com

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Comments

Post a Comment